News

LAND RESUMPTION NEWS - $510,000.00 SECURED IN COSTS Legal and other costs paid by resuming authority may now outweigh compensation paid by Department of Transport and Main Roads Kelly Legal is pleased to announce its client, Mr Clive Desbois, has been paid the sum of $510,000.00 for costs associated with his successful claim for compensation against the Department of Transport and Main Roads after his land was compulsorily resumed for the Mackay Ring Road. The costs paid by the Department of Transport and Main are in addition to the $1,018,385.00 (plus interest) that was previously awarded to Mr Desbois as compensation for the value of his land that was resumed. It is also in addition to the costs that the Department was ordered to pay Mr Desbois after an appeal to the Land Appeal Court was successfully determined in his favour. Background The payment of costs is the final step in what has been a long process for Mr Desbois, who was forced to commence proceedings after the Department of Transport and Main Roads resumed his land in 2016 and offered him $67,000.00 for it. After a lengthy litigation process involving expert evidence and a week-long trial, in late 2021 Mr Desbois was awarded compensation totalling $948,961.00. This amount was later increased following a successful appeal by Mr Desbois, with the amount of compensation payable to Mr Desbois being increased to $1,018,385.00 plus interest. The Department was also required to pay Mr Desbois’ costs. Comment Given the amount of costs that the Department has now been ordered to pay Mr Desbois for both the initial Land Court hearing, and the appeal to the Land Appeal Court, as well as the costs that would have been paid to the Department’s own lawyers and experts, it may now be the case that the costs incurred by the Department of Transport and Main Roads in fighting Mr Desbois’ claim for compensation will exceed the compensation that it was ultimately ordered to pay. If it is the case that the Department is willing to spend more on costs than what the landowner is entitled to be paid for compensation, then (as we have previously written here ), we consider it is an appropriate time for a review of Queensland’s compensation laws, particularly regarding the costs provisions which, when compared to every other state and territory, could be interpreted as a deterrent to dispossessed land-owners seeking compensation through the Court system.

Kelly Legal and The Property Law Centre team are pleased to have been able to assist Mr Clive Desbois in his fight against the Department of Transport and Main Roads (‘the Department’) for fair compensation following the resumption of his land for the Mackay Ring Road Project. The most recent victory by Mr Desbois is an important one – apart from increasing the amount of compensation paid to Mr Desbois, the decision means that Mr Desbois is the only party entitled to a costs order being made in his favour. Kelly Legal is pleased to confirm that the Land Court has now made orders requiring the Department to pay Mr Desbois’ costs on top of the compensation already payable. Summary of the legal battle On 12 August 2016 the Department compulsorily acquired land from Mr Desbois offering to pay only $67,000. After initial attempts to negotiate with the Department proved unsuccessful, in 2019 Mr Desbois was forced to file an application in the Land Court for adequate compensation. The Department maintained that the land resumed was worth only $67,000.00. After a lengthy litigation process involving expert evidence and a week-long trial, in late 2021 Mr Desbois was awarded compensation totalling $948,961.00. Both the Department and Mr Desbois were dissatisfied with the amount awarded and filed appeals. In its appeal the Department maintained that compensation should only be $67,000, whilst Mr Desbois sought an increase in compensation. The Department’s appeal was ultimately dismissed while Mr Desbois’ appeal was granted. The Department was ordered to pay Mr Desbois’ costs of both appeals, and the matter was sent back to the Land Court to be reconsidered. After further argument from both sides, on 26 August 2022 the Land Court delivered its reconsidered decision, increasing the amount of compensation to $1,018,385.00 plus interest. Effect on court costs Importantly, the increased compensation award had the effect of entitling Mr Desbois to apply for his costs of the Land Court proceedings. As a result of the somewhat unusual operation of the Queensland’s acquisition laws and their costs provisions (which have not been amended since 1967), the initial award of compensation did not entitle Mr Desbois to apply for his costs. The Land Court has now ordered that the Department pay Mr Desbois’ costs on top of the compensation awarded to him. Legislative considerations Kelly Legal considers that it is an appropriate time for a review of Queensland’s compensation laws, particularly regarding the costs provisions. The current position in Queensland (and indeed the position that has existed since 1967) is that unless a landowner beats what is referred to as the ‘mid-point’ between the amount they claim in compensation and the amount the Department (or any other resuming authority) contends is the appropriate amount, then they will have no entitlement to claim their costs of the proceeding. This is an unusual provision, particularly when contrasted to other states such as NSW where the power to award costs is discretionary and it has been held there that: “…in the ordinary course, a dispossessed owner can expect to obtain the usual order for costs in their [sic] favour, particularly when the amount of compensation determined is greater than that offered by the resuming authority”. - Jagot J in Simpson v Bagnall [2008] NSWLEC 79. If a similar approach to that which is employed in NSW was adopted in Queensland, it would go some way to restoring some faith in disposed landowners that they won’t be disadvantaged in seeking fair compensation for land that has been taken from them, and quite often, taken without their consent. It would also not prevent the Court from exercising their discretion and declining to award costs if that is the appropriate course, for example where a disposed landowner may be found to have acted unreasonably or to have rejected an otherwise reasonable offer by the resuming authority. In 2014, following what has been described as ‘years of disquiet’ about its acquisition legislation and its enforcement by resuming authorities, the NSW government commissioned David Russell SC (now a judge of the NSW District Court) to carry out a broad review which resulted in a number of positive recommendations being implemented by the government. Given the approaching 2032 Queensland Olympic Games, it’s likely that the number of people affected by land resumptions will only grow. Although it is an issue that touches only a small number of people, those that have been through the resumption process know just how difficult it can be to achieve fair and reasonable compensation. A similar review to that carried out in NSW may provide some assurance to Queensland landowners that if they become part of that small minority, they will not be disadvantaged during the resumption and compensation process. Kelly Legal - we’re With You Sean and Patrick Kelly of Kelly Legal, together with Errol Morzone QC and Denika Whitehouse of counsel, assisted Mr Desbois throughout the initial proceeding, the appeal process, and the remitted proceeding. With offices located in both Mackay and Brisbane, Kelly Legal provides expert guidance to clients throughout Queensland. If you have been affected by a resumption or believe that you may be affected be a proposed resumption, please don’t hesitate to contact a member of our friendly and experienced team to help you through the process.

All levels of government - federal, state and local - have powers to compulsorily acquire land for government purposes. In Queensland, compulsory acquisition is primarily administered by the Acquisition of Land Act 1967 (Qld). Under the Acquisition of Land Act 1967 (Qld), the purposes for which land may be taken are varied and include roads, railways, soil conservation, dams, drainage and even “experimental farms”. Other legislation also authorises the taking of land including the Electricity Act 1994 (Qld) and the Petroleum and Gas (Production and Safety) Act 2004 (Qld). If land is proposed to be acquired, the constructing authority must serve the landowner with a Notice of Intention to Resume. The Notice of Intention to Resume will specify the date by which the landowner may object to the resumption. Following a hearing and consideration of any objections, a final decision will be made by the constructing authority. If the compulsory acquisition is approved, a formal proclamation is published in the Government Gazette. Unlike compulsory acquisitions by the Commonwealth, the entitlement to compensation on just terms provided for in the Constitution does not apply in Queensland. Instead, the Acquisition of Land Act 1967 (Qld) generally entitles a person having an interest in the land resumed to compensation and identifies the principles to be taken into account when calculating the compensation payable. In determining the compensation payable, regard will be had to the “highest and best use” of the property and not necessarily its current use. Compensation may also be available for “disturbance costs” incurred as a result of the resumption. Disturbance costs may include legal costs, the cost of purchasing a replacement property, removal and storage costs and loss of profit or other economic losses due to the interruption of business. If the amount of compensation cannot be agreed upon, the landowner can apply to the Land Court for an assessment. If your land is affected, or potentially affected, by a compulsory acquisition, you will often be invited to a meeting with the authority intending to resume the land. It is critical that before you agree to such a meeting that you understand your rights and obligations under the Acquisition of Land Act 1967 (Qld) and obtain appropriate advice.

A common situation that we would have all witnessed in shopping centres is when there is an accidental spill of a drink, ice-cream, or anything that can create what we will refer to as a “slip hazard”. If you are the unlucky one who comes across that slip hazard and it results in a fall and an injury, you are not automatically entitled to compensation. To enable a claim for personal injury to be successful, it is essential to prove that another person was responsible for the accident that caused your injury. That is, you need to establish negligence. To prove negligence, you must show that another person, or entity, failed to uphold their duty of care. This involves various considerations including whether the incident was reasonably foreseeable. In the case of a slip in a shopping centre, there have been various cases that have explained how negligence is to be established. Was there adequate measures taken to avoid the risk? One of the first investigations we would suggest in these cases is to examine the cleaning records of the shopping centre. Those records can be the telling point as to whether you will have a case or not. If you are not sure whether you have a claim, it is best to find out. We will look into that claim for you, at no charge, to determine your individual circumstances and advise you accordingly.

Clients are often mystified as to the calculation of a just and equitable division of property between parties to a marriage, de facto or same sex relationship. For decades, there has been a misconception amongst the public that at the end of a relationship, each party is automatically entitled to 50% of the property pool. This is simply not the case. In fact, the calculating of what a person’s “just and equitable” entitlement is can be a long and arduous road. Prior to judgment of the High Court of Australia of Stanford v Stanford in November 2012, the courts in family law matters adopted a four step process in a property settlement application. It seems now that any court in considering an application for division of matrimonial or defacto property must first determine the legal and equitable interests of the parties then determine whether it would be just and equitable to make an order altering those interests. If at this first new step the court assumes that it would be just and equitable to divide property then the old four step process would be considered as follows: 1. Identification and valuation of the property pool Identify the net pool of assets (including superannuation) of the relationship – whether they are in your name, your spouse’s name, or joint names. 2. Assessment of the contributions of the parties Identify the contributions, both financial and non financial, made by each party to the relationship, and also take into account any indirect contributions in a financial and non financial way. Direct financial contributions will be by way of earnings, and indirect contributions will be by family or friends and may include financial contributions, i.e. gifts in that regard, and non financial contributions by family and friends will be by way of assistance they may provide, e.g. constructing fence, carport, stairs. The parties to a de facto/marriage relationship would expect that ultimately assets will be divided in accordance with the assessed percentage of contributions. 3. Adjustments for future factors At this point the court will consider whether the assessed contributions at step 2 need to be adjusted by giving further weight to any future needs aspects including age, state of health, or earning capacity, and obligation by one party to care for the child (if any) of the relationship. Contributions financially throughout the relationship/contributions in relation to homemaking responsibilities and caring for children will also be considered. 4. Assessment of justice and equity At this point the court will consider whether the proposed apportionment identified at step 3 will meet the overruling obligation to divide the assets on a just and equitable basis. If the court is not satisfied that the proposed apportionment will meet the just and equitable requirement the assessment will be reviewed. Things to be mindful of when separating 1. You should amalgamate all superannuation funds into one fund, and ensure that you have removed your former spouse as a beneficiary by contacting the trustee of your superannuation fund/s. 2. Similarly you should arrange for the company of any life insurance that you may have to remove your former spouse as beneficiary and consider including a new beneficiary. 3. Arrange to make a new Will and Enduring Power of Attorney. 4. Arrange to remove any access that your former spouse may have to any bank accounts including home loan accounts, credit card accounts, term deposits etc.

The alienation of a child from a parent most often occurs in high conflict disputes regarding the parenting arrangements for their children. It occurs when the relationship between a parent and a child is broken through the behaviours of the “aligned” parents. Common behaviours and organising beliefs of the aligned parent includes[1]: Extremely negative views of the rejected parent freely, angrily and repeatedly expressed to the child by the aligned parent; Innuendos of sexual or child abuse or that the parent is dangerous in other ways; A belief that their child does not need the other parent in their lives; A belief that the rejected parent is dangerous to the child in some ways, either violent, physically or sexually abusive, or neglectful, thus justifying behaviour aimed at blocking time with the child; A belief of the aligned parent that the rejected parent does not and has never loved or cared about the child; Rejected parent’s behaviour which contributed to child alienation include[2]: Passivity and withdrawal in the face of high conflict; Counter-rejection of the alienated child; Harsh and rigid parenting style; Rejected parent is self-centred and immature; Rejected parent has critical and demanding traits; Diminished empathy for the aligned child. Here are some tips to help combat parental alienation[3]: 1. Don’t become an alienator. This is the most important tip. When you’re experiencing parental alienation, you will have a natural tendency to act defensively and always explain yourself to the children. Worse, you may want to counter the negative behaviour and talk about what horrible things your ex has done. This is alienation, too. Don’t fall into the trap by following your natural desire to defend yourself against false accusations. 2. “I love you” always. When you do spend time with your children, regardless of the method, tell them that you love and care for them and that they are often in your thoughts and heart. Let them know they are special to you. 3. Positive language, always. This is often overlooked but it is very important to avoid the use of negative language. It’s simple and it’s subtle; sometimes we call it “think like the child.” Examples of using positive language include: Instead of “I miss you…” which can put the child in a position to feel guilt or upset, use “I look forward to the next time I see you!” This is more upbeat and positive. Instead of “I wish I could have seen that…” which conveys a lost opportunity or a regret, use “Wow, that’s great to hear and must have been very exciting!” as this conveys excitement, support, and positive reinforcement regarding whatever experience is the topic of conversation. 4. Never stop contact efforts. Even if you know that your cards, letters, gifts, emails, voice-mails etc are being intercepted or are otherwise never delivered – don’t give up trying. Keep a diary or journal of your efforts to contact your children as well as writing to your children as if they were going to read it – SOME DAY. This will prove helpful both for you and, hopefully, your children if they have the opportunity to find out the truth at some time in the future. 5. Control yourself. Manage your emotions. It is vital that you follow your court orders and agreements and avoid giving your high-conflict ex-partner any reason to vilify you to the children more than they already have. 6. Avoid blaming the children. Try to remember that the children are also victims in this mess. Although difficult, it is often that when parental alienation is occurring, your children may spy on you, talk about every move you make, every purchase you do, report on who you talk to or spend time with. This might be part of the alienator’s strategy, and you could become frustrated at the children and blame them for fuelling the ex partner’s behaviour. Don’t let this happen. 7. Be yourself. Act as you always have and do, in the children’s best interests. This will ensure that as much as possible, the children will not see you as you are being portrayed by your ex-partner. Don’t overdo this though – there is no need to be “extra special” to counter your ex’s false allegations. Just be your usual loving, caring, nurturing self. Always remember that your actions will forever speak louder than you ex-partner’s words, particularly as your children mature. 8. Keep your plans, always. If you have made special plans or arrangements with your children do not change your plans just because you fear your ex-partner will not permit the children to spend time with you as previously arranged or ordered. If you are late or fail to show one time, it may be twisted by your ex-partner into “proof” of your lack of caring for the children and give them the power to further alienate the children from you. 9. Build the relationship with memorable moments. We do not mean becoming the “Disney Land Parent” however, a nice vacation, having a catch with the ball, sharing a professional sporting event, or for younger children reading a book together, movie watching etc can be special moments you can share with your children and help build a strong relationship and bond between you and your children. 10. Create the best team of professionals you can afford. Legal professionals, mental health professionals, therapists, articles, scholarly studies with solid data are all invaluable tools to assist you with combating parental alienation. Be sure that whatever professional you use is knowledgeable and experienced with parental alienation and can advocate for the appropriate changes that will benefit your family. [1] Calvert & Calvert [2008] FMCAfam 101. [2] Ibid. [3] https://lawpath.com.au/legal-articles/10-tips-to-combat-parental-alienation

Effective estate planning protects assets and minimises tax liabilities. An otherwise effective estate plan may be compromised, however, by challenges to the estate (for example, a family provision application) with the unwelcome result that assets are dealt with in a way inconsistent with the intentions of the deceased. A family provision application involves a person making an application to the Court for “adequate provision” from the estate of a deceased person for his or her proper maintenance and support. The applicant either seeks a share of the estate (where no provision has been made) or a larger share of the estate. Notice of an intention to make a family provision application must be given within six (6) months of the date of the death of the deceased person, and the application must be filed in the Court within nine (9) months. The timeframes for the making of a family provision application are strict and must be complied with. In Queensland, a spouse, child (including a step-child) or a “dependent” are eligible to make a family provision application. A person is a “dependent” if they are wholly or substantially dependent upon the deceased for maintenance and support at the time of death and are a: parent of the deceased person; the parent of a surviving child under the age of eighteen (18) years of the deceased person; or a person under the age of eighteen (18) years. Determining family provision applications involves a two-stage process. Firstly, the Court must consider whether the deceased person has failed to make adequate provision for the proper maintenance and support of the applicant. Secondly, if the Court is satisfied that adequate provision has not been made, the Court must determine what provision should be made for the applicant. In determining what provision should be made for the applicant (if any), the Court will look at all the circumstances of the case including the size and nature of the deceased person’s estate, the applicant’s financial position and the relationship between the applicant and the deceased person, to name a few. The possibility of a family provision application should be considered when making a Will and steps taken to minimise the risk of an application.

One of the common disputes with wills concerns determining whether or not the person who made the will - who by then is usually no longer with us - had what is known as “testamentary capacity”. In other words, were they capable, in the eyes of the law, of making the will at the time they did? But what does this actually mean in practice? How can you tell if a will is valid or invalid? The law in this area revolves around a very old English case (from the year 1870) by the name of Banks v Goodfellow. The test set out in this case has been adopted many times in Australia and confirmed by courts all the way up to the High Court of Australia as constituting the law in this country. Under the Banks v Goodfellow test, a person making a will must: understand the nature of the will and its effect have some idea of the extent of the property of which they are disposing under the will appreciate the claims to which he or she should give effect. Importantly, all three of these limbs must be satisfied. Usually the first two are relatively straightforward, but the third one can be an area of hot dispute - particularly if one or more of the beneficiaries believes that they have been dealt a harsh hand by the will maker. To satisfy the third limb, it needs to be shown that the person who made the will: was able to recollect who their expected beneficiaries should be was also able to understand why those people would have claims on the estate and based on this, has made a conscious, rational and free decision to exclude or limit the entitlement of one or more of the beneficiaries. Some judges in applying these tests have looked at the will itself and used it as proof in itself of irrationality. Such cases will usually involve dramatic or sudden changes made to a will. In other cases, judges have tended to treat the will itself as sacrosanct in the absence of direct evidence of incapacity which, when we are talking about a deceased person, can be quite difficult. The lesson for will makers is to make sure you consider these issues when working what to put in your will and how to go about making it. For beneficiaries, particularly those who believe they have been treated unfairly, this is an area to have a very close look at.

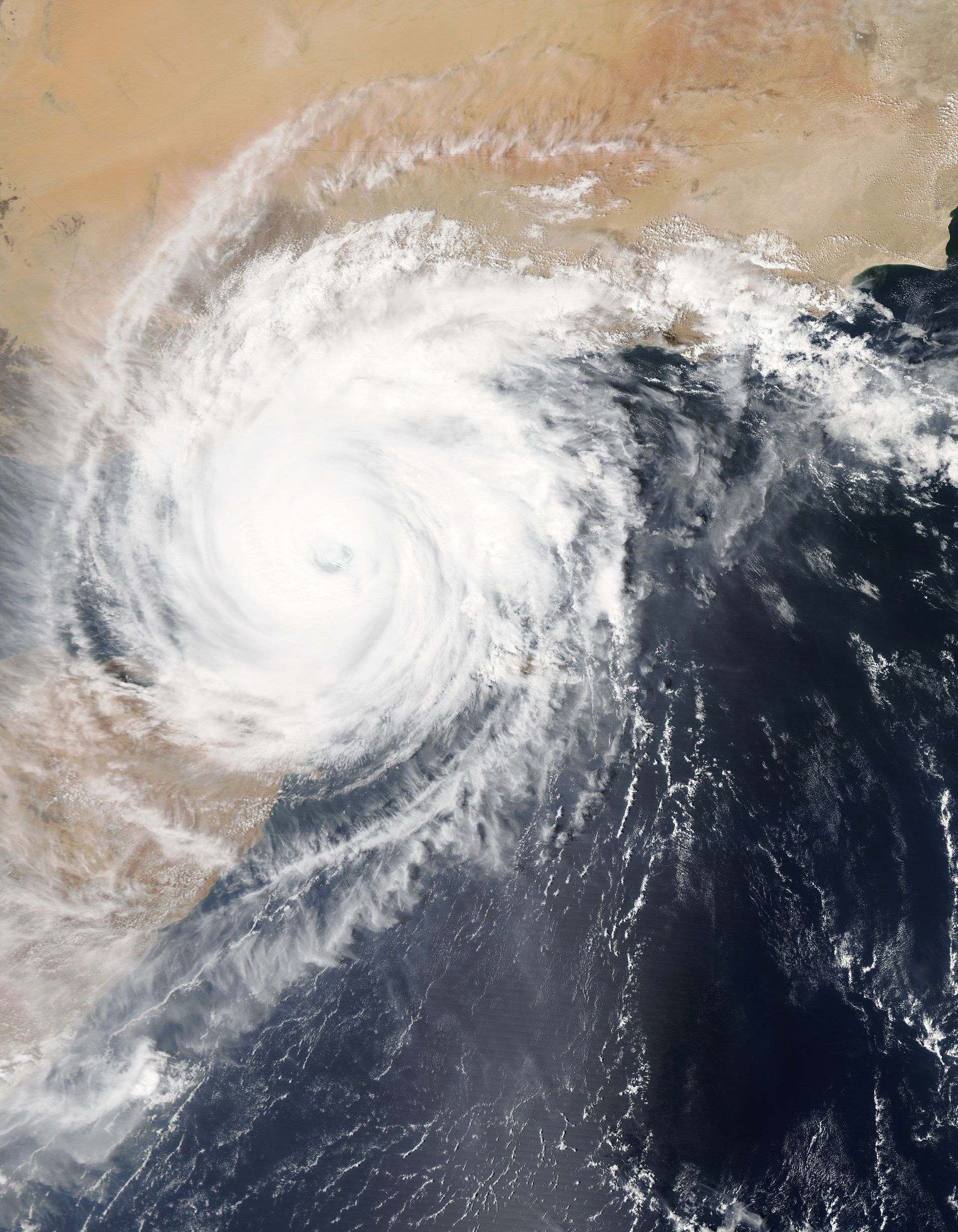

Property at the buyer’s risk pursuant to contract terms… If you have sold or purchased residential property in Queensland before, you would likely be aware that the risk of that property generally passes from the seller to the buyer on the first business day after the contract date. Buyers should ensure that they have taken out adequate insurance cover over the property they are intending to purchase. Although not necessary, it would be prudent for sellers to retain insurance over the property until such time as settlement has been achieved, at which point a pro-rata refund may be sought from the insurer. Storm damage that renders the property unfit for occupation… If a property is a dwelling (e.g. a house or unit as opposed to vacant land), and that dwelling has been so destroyed or damaged so as to be deemed unfit for occupation, buyers have some relief pursuant to section 64 of the Property Law Act 1974. In such circumstances, a buyer may elect to rescind the contract by notice in writing to the seller or the seller’s solicitors, delivered before the date for settlement or possession. Where a buyer elects to rescind, any monies payable by the buyer (e.g. contract deposit) must be refunded in full to the buyer. A prudent seller will have maintained their insurance after the contract date and depending on the terms of that insurance may be able to make an insurance claim for the storm damage. Storm damage that does not render the property unfit for occupation… This is the problem area for the buyer. If a property has suffered damage but the damage does not render the property unfit for occupation, the buyer must proceed to settlement and cannot avoid the contract because of the damage no matter how extensive that damage is. The buyer will be responsible for repair of the damage. The prudent buyer who has taken out insurance from the date of the contract will be able to rely on that insurance. If the buyer has failed to take out insurance the buyer must still proceed with settlement and will have to pick up the cost of repairing the damage without the benefit of any insurance cover. Another complication which a buyer may face is that their financier may withdraw their offer due to the uninsured damage and the buyer will be left without finance. The buyer must still proceed with settlement and if they can’t raise the funds will be in default under the contract and will have to deal with the consequence of default. Buyers may be tempted to hold off taking out insurance until just before settlement. However, if a storm or cyclone event occurs before settlement the uninsured buyer could find themselves in all sorts of trouble. Recommendations & tips… As with most legal matters, there is always room for interpretation. What one person may consider ‘unfit for occupation’, another may disagree. We recommend that you always seek advice from a qualified legal professional, and when entering into contracts for residential property, consider: - Insurance – take out adequate insurance cover if you are a buyer. For sellers, consider retaining your policy until settlement. Inspections – buyers should carry out a thorough inspection before entering into a contract and make notes of any existing damage or defects. Communication – sellers should notify buyers as soon as it is apparent a property has been damaged by a storm (or other natural disaster). Failing to do so, may result in complications as settlement approaches.

“Pay nothing for 18 months” “No sign up fees” “No interest, payment plans” “No Win, No Fee” From signing up at the gym, refinancing a credit card, to signing up with your lawyer, these are the slogans we are hearing. It sounds enticing, it sounds risk free. It is, in most cases, a legally binding contract. These contracts have laws that surround them and must be adhered to. When drafted correctly, these slogans relate to contracts which provide access to what are often essential services or products in our society for those who otherwise are unable to afford them. If you are unsure about whether the contract you have entered into is indeed as good as it is made out to be, you should seek legal advice BEFORE signing. We encourage all of our clients to seek advice on any client agreement and it is important that all clients know what their rights are, regardless of the transaction. You also have that right when you enter into any agreement. But you should act quickly if you have already signed up, as cooling off periods don’t last forever. Our team at Kelly Legal are here for the every day person, with every day concerns. We just tell you how it is, in down to earth terms. Whether you are negotiating a huge deal, or trying to work out whether the fine print of an offer is best for your individual circumstances, we’re with you. Come and see our team to ensure what you have entered into or are considering entering into is indeed the best way forward for you.